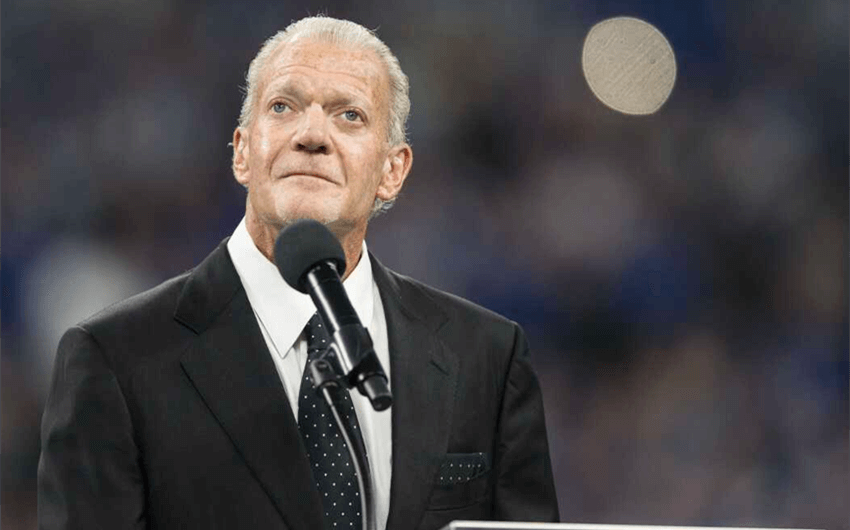

Jim Irsay Net Worth: Colts Owner’s Billionaire Fortune, Assets, and Legacy Explained

Jim Irsay net worth is widely discussed because he wasn’t just a sports figure—he was the controlling owner of an NFL franchise, and that kind of asset can create generational wealth. While no private estate is perfectly transparent, most credible estimates placed his fortune in the multi-billion-dollar range, driven primarily by the value of the Indianapolis Colts and supported by high-profile collectibles, real estate, and long-term investments.

What was Jim Irsay’s net worth?

Because he was a private individual with private holdings, there is no single “official” public number that functions like a bank statement. Still, the most commonly reported estimates put Jim Irsay’s net worth at around $5 billion, with many reports placing him roughly in the $4.8 billion to $5.8 billion range around the time of his death in 2025. The exact figure varies because net worth isn’t one simple pile of cash—it’s a moving total based on asset values, debt, liquidity, and what a buyer would actually pay for major holdings.

It’s also worth noting that after someone dies, “net worth” becomes an estate question. Values can change as assets are appraised, as properties are listed or sold, and as taxes and obligations are calculated. So when you see different totals, it doesn’t always mean someone is “wrong.” It often means they are counting different pieces, using different valuation dates, or making different assumptions about how easy it would be to turn certain assets into cash.

The main reason his net worth was so high: the Indianapolis Colts

For Jim Irsay, the Colts weren’t a side investment—they were the center of the financial universe. NFL franchises are among the most valuable sports assets in the world because they combine scarce supply (only 32 teams exist), massive national media revenue, strong local revenue streams, and a league structure designed to protect competitive and financial stability.

Even if you never look at the exact franchise valuation, the logic is straightforward: if you own a team worth several billions of dollars and you control that asset, your net worth will naturally land in the multi-billion range. That’s why discussions about his wealth almost always begin and end with one fact—he owned an NFL team.

How Jim Irsay got the Colts and what “ownership” really means

Jim Irsay’s wealth story began as a family business story. His father, Robert Irsay, acquired the Colts in the 1970s and later moved the franchise from Baltimore to Indianapolis in the 1980s. Jim grew up inside the organization and worked in a variety of roles before ultimately taking over as the principal owner in 1997.

That inheritance angle matters because it explains why his net worth wasn’t built the way most fortunes are built. He didn’t create a startup, go public, and sell shares. He inherited a rare, appreciating asset and then spent decades managing it while the value of NFL franchises rose dramatically over time.

Ownership also doesn’t always mean you “own every dollar” of a team in a simple way. NFL ownership structures can involve trusts, estate planning tools, minority interests, and other arrangements. But if you are the controlling owner, you effectively hold the power position—and the market tends to price that power at a premium.

Why franchise value translates into personal wealth

People sometimes ask: “If the team is worth billions, does that mean the owner has billions in cash?” Not necessarily. The value of the franchise is real, but it’s not liquid unless you sell all or part of it or borrow against it. Owners often build wealth in a way that looks “illiquid but enormous.” They may have substantial liquidity, but the biggest chunk of net worth sits inside the team’s value.

This is why net worth estimates can feel abstract. In practice, the team can fund a luxurious lifestyle, support borrowing capacity, and create long-term security—even if the owner never sells it. The wealth is real, but it behaves more like a huge asset portfolio than a giant checking account.

Other major assets that likely shaped his estate

While the Colts were the cornerstone, Jim Irsay was also known for holding other high-value assets that could meaningfully affect net worth—especially at the margins where estimates differ by hundreds of millions.

Real estate holdings

Wealthy owners often place significant money into real estate, and high-end property can become both lifestyle and long-term asset storage. Irsay owned notable homes, including luxury properties that received public attention after his death. High-value real estate can move net worth numbers because appraisals can vary, selling prices can differ from listing prices, and some properties include expensive features that do not always translate cleanly into resale value.

Real estate also comes with liabilities—property taxes, upkeep, staff, insurance—so the “headline price” is only part of the story. But if a property was owned for years in the right market, appreciation alone can add meaningful value to an estate.

The Jim Irsay Collection: memorabilia with serious market value

One of the most distinctive parts of Irsay’s financial profile was his world-famous memorabilia collection—an enormous set of cultural and historical artifacts that included iconic music items, sports history pieces, and rare documents. Unlike typical luxury spending, a collection like this can function as an alternate asset class. Some items can appreciate dramatically, especially if they are one-of-one pieces tied to major cultural moments.

At times, the collection was described in terms that suggested extremely high valuation—numbers that can sound unbelievable until you remember how intense the high-end auction market can be for rare, culturally significant artifacts. Still, collectible valuations are notoriously variable. A collection might be “worth” a huge number in theory, but the real value is what buyers will pay at auction over time, after fees, taxes, and market conditions are considered.

Even so, this collection likely mattered to net worth estimates because it was both massive and publicly visible. It also represented a potential liquidity event: if the estate chose to sell key pieces, it could convert cultural assets into cash—sometimes at staggering prices.

What net worth estimates often miss: liabilities, taxes, and liquidity

When someone is worth billions, the differences between estimates often come down to three questions: how much debt exists, how much cash exists, and how aggressively taxes and fees are counted.

Owners sometimes borrow against assets for real estate, business investments, or liquidity management. Borrowing doesn’t mean financial trouble—it’s often just a strategy. But it can reduce net worth depending on how it’s counted. On top of that, estates can face major tax obligations, and those obligations can influence what the family retains versus what must be sold.

That’s why a range makes more sense than a single number. A person can be “worth $5 billion” on paper while the estate still needs to make careful decisions about which assets to keep, which to sell, and how to manage long-term cash flow.

Philanthropy and how giving fits into the wealth story

Jim Irsay was known for philanthropy, including support for community projects in Indianapolis and mental health initiatives. Charitable giving doesn’t always change net worth estimates in a simple way, because giving can be structured through foundations, donor-advised funds, direct grants, and long-term commitments.

But it matters for legacy. For many billionaire owners, the wealth story isn’t only about accumulation—it’s also about what the money builds in the community and what remains after the owner is gone.

What happened after his death: ownership transition and the “family fortune” question

After Jim Irsay died in 2025, the Colts entered a new era under his daughters, who stepped into controlling roles in the franchise’s ownership structure. This is important because it reframes the net worth conversation from “his personal wealth” to “the Irsay family wealth,” with the Colts as the central asset.

In these situations, the team’s value can continue to rise even after the original owner is gone. That means the family’s overall financial position may grow over time, independent of what the owner’s net worth was on the date of death. In other words, the net worth story doesn’t stop—it evolves into an estate and generational wealth story.

Why people keep searching “Jim Irsay net worth”

There are two reasons this question stays popular. The first is obvious: people are fascinated by billionaire wealth, especially when it’s tied to iconic sports teams. The second is more human: Jim Irsay wasn’t just a distant executive name. He was a visible, outspoken owner with a public personality, public passions, and public struggles. When someone like that dies, people naturally try to understand the scale of the life they lived—not just in emotional terms, but in financial terms too.

His wealth story also illustrates something bigger about modern sports: owning a franchise has become one of the most powerful wealth engines in America. The team becomes a platform for revenue, influence, philanthropy, and legacy all at once.

Bottom line

Jim Irsay’s net worth was most commonly estimated at around $5 billion, often described within a broader range of roughly $4.8 billion to $5.8 billion around the time of his death in 2025. The Indianapolis Colts were the primary driver of that wealth, with additional value tied to real estate and a famous collection of high-end memorabilia. While the exact number depends on private financial details, the overall picture is clear: he was a billionaire sports owner whose fortune was built on controlling one of the most valuable assets in American entertainment—an NFL franchise—and whose legacy now continues through family ownership and long-term estate decisions.

image source: https://www.npr.org/2025/05/22/nx-s1-5407385/jim-irsay-obituary-indianapolis-colts